|

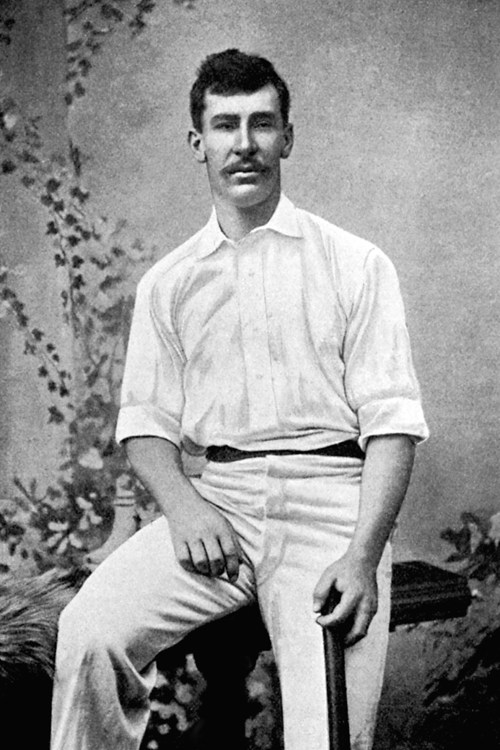

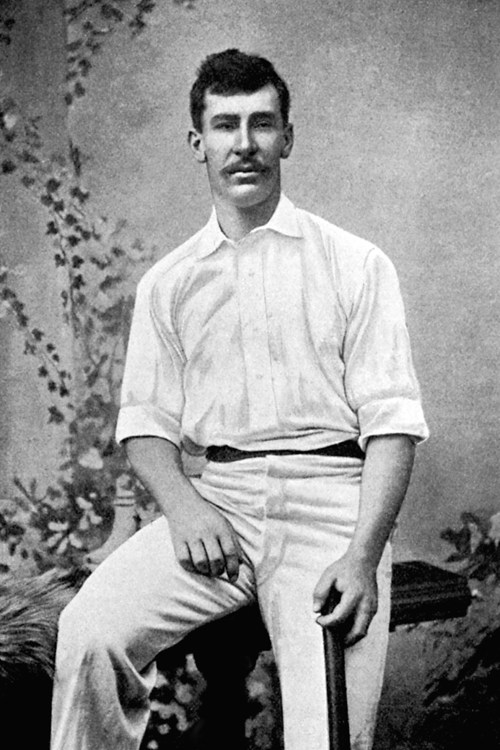

Albert Trott: legend has it he bowled himself into the poorhouse

© The Cricketer

|

|

James Seymour played more than 500 times for Kent between 1900 and 1926, and was part of their great pre-war side. These days, he is an almost forgotten figure in the game's history. But just as footballers owe a debt of gratitude to Jean-Marc Bosman, the Belgian international whose landmark case paved the way for free movement of out-of-contract players, many of England's cricketers - indeed footballers as well - should be equally grateful to Seymour. It is because of him that money raised from benefits is not taxed.

In this day and age, benefits are slickly run businesses, often employing professional fund-raisers. Until comparatively recently, however, they usually consisted of one match where the professional could keep the gate money and any collections. For the poorly paid county stalwart, a benefit could make the difference between a comfortable retirement and poverty.

In 1920 Kent awarded Seymour a benefit, and he chose the game against

Hampshire at Canterbury at the end of July. The match was a success, with Kent winning by 165 runs. Seymour, however, was run out for 0 in their first innings, although he helped fill the collection boxes with a second-innings 74.

While some earned large sums - Cyril Washbrook in 1948 raised the then-considerable sum of $14,000 - others fared less well. In 1907 Albert Trott

ruined his own benefit match by taking four wickets in four balls and then the hat-trick, finishing the game early at a time when people were prepared to roll up in their thousands, prompting him to ruefully comment that he had "bowled himself into the poorhouse". Seven years later, broke and broken, he shot himself. And in 1953, Somerset's Bertie Buse took 6 for 41

against Lancashire at Bath, but he ended up on the losing side and out of pocket as the game didn't even last into a second day on a minefield of a pitch.

Back to Seymour. His benefit was more successful than most, producing enough money for him to be able to buy a fruit farm in Marden in 1923. As was the norm in those days, the county kept the money until Seymour convinced them that he had a worthwhile project to invest it in. This was done to some extent to prevent some players drinking or gambling away what amounted to their pension.

But the benefit attracted the attention of the Inland Revenue, who since a change in the law in 1918 had been eyeing sportsmen's income from this source and were increasingly unhappy that it was not liable to tax. They decided to take Seymour to court. Seymour was by no means a sophisticated man, but he felt wronged. Rather than rolloing over, he fought the Revenue.

The case eventually reached the High Court where Justice Rowlett, the leading revenue judge of the time, ruled that what he described as a "very large sum" constituted a non-taxable personal gift. His decision was in turn overturned by a majority of the Court of Appeal, but was restored by a majority of the House of Lords.

Announcing their decision, Lord Phillimore said: "My Lords, I do not feel compelled by any of authorities to hold that an employer cannot make a solitary gift to his employee without rendering the gift liable to taxation. Nor do I think it matters that the gift is made during the period of service and not after its termination, or that it is made in respect of good, faithful and valuable service."

Although the question of benefits has not really been raised again - although in 2001 Richard Caborn, the sports minister, said that the government would review the situation - the Reed v Seymour case continues to hold sway. In 1958, Lord Justice Jenkins referred to it as follows:

"It must, I think, be remembered that Reed v Seymour was a case turning very much on its particular facts, and it was, as I see it, a vital element in the case that the benefit match was held and the gate money was collected on the eve of the retirement of Seymour after a long and brilliant career as a county cricketer playing cricket for the county of Kent. It was a 'once and for all' payment after very long service and after a long career spent in entertaining the public. It was made at the proper time for making a testimonial, that is to say, on the eve of the retirement of the person to whom it was being given."

As a result, no cricketer has been taxed on income deriving from a benefit since. How long this situation carries on is uncertain, and the massive sums being raised by players who are much better paid than their predecessors anyway - a far cry from the relative paupers of old - will sooner or later attract the attention of the Inland Revenue.

As for Seymour, he never really enjoyed the rewards of his own benefit, dying in 1930 aged only 50. His legacy, however, lives on.

Is there an incident from the past you would like to know more about? E-mail us with your comments and suggestions. Martin Williamson is managing editor of Cricinfo